Who This is For

Anyone looking to invest in short-term rentals in Central Texas whether its your first time or updating your portfolio

First-time STR buyers

Tech professionals & high earners

Out-of-state investors

Buyers seeking tax-efficient real estate

Investors scaling to property #2+

2nd home or vacation home buyers

What You Get When You Work With Me

STR-specific deal analysis (not generic MLS searches)

Revenue modeling + downside scenarios

Zoning & regulatory guidance

Tax-aware acquisition strategy (with your CPA)

Design + furnishing strategy for performance

Out-of-state investor support

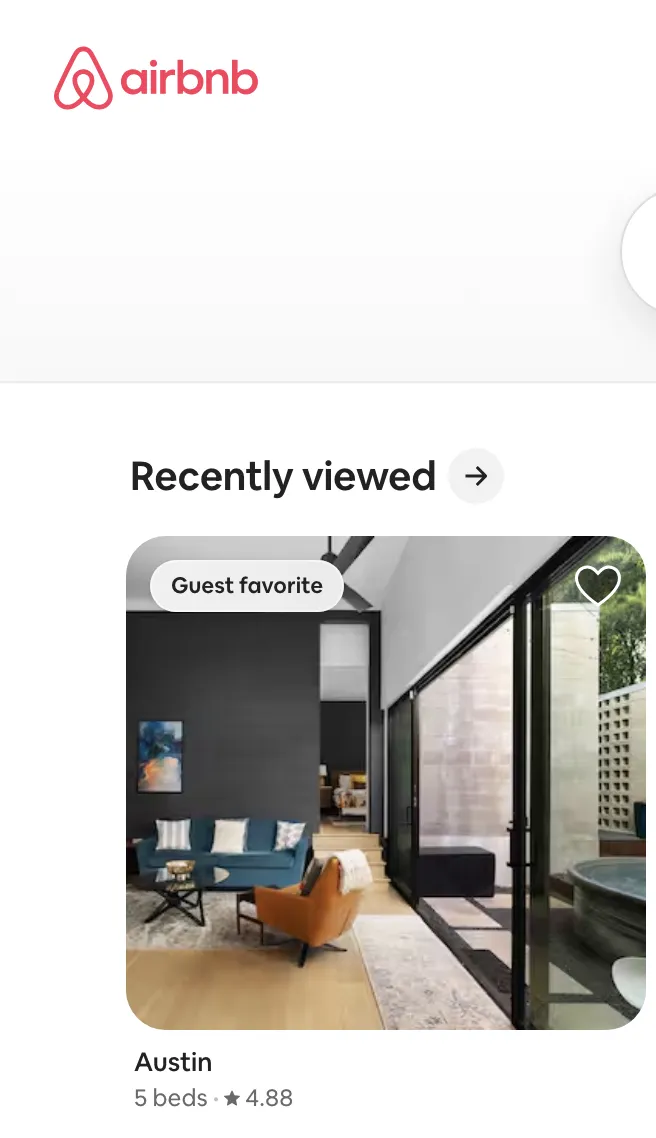

Short-Term Rental Cases

East Austin Cost Segregation Goals

Learn how cost segregation helps tech workers save on their tax burden.

Learn More

ADU Revenue Generator

Using a HELOC loan to build an ADU and generate revenue to payoff the primary home.

Learn More

Part-Time Home and Part-Time STR

Using a home that was vacant 6 months of the year to pay for itself.

Learn More

Why Austin For Short-Term Rentals?

Industries

Austin is home to many big tech companies, manufacturing, a top-rated, university, start-up environments, the state capital, and along the i-35 corridor which runs from Cananada to Mexico.

Regulation Reality

Although Austin does have regulation it is friendlier than some states and less volatile.

Affordability

Most investors can start looking at homes in 300s and go up from there which is much lower than many other metros.

Events

Austin host year-round events including Austin City Limits, South-By-Southwest, Formula 1, UT Football, major concerts, business conventions, and more!

Need to Estimate Numbers

Let me talk you through how to do to make sure you don't have any blind spots

Planning to Build a Portfolio

Let's talk goals, most investors want vacations homes but it might not be the best first step.

Julie Hutchison

Short-Term Rental Expert

Julie started real estate as an investor first and then got licensed to help investors like you. Prior to real estate she was a data analytics director so she knows how to look at data and numbers. She leads with knowledge and a data driven approach to help investors at any stage of their game. She doesn't just sell STRs, she owns and operates them.

What Our Owners Say

Julie made our home buying experience smooth and stress-free. Right from the start, Julie took the time to understand our needs and preferences. She patiently walked us through every step of the process, explaining everything in detail and answering all our questions thoroughly. We never felt rushed or pressured, and her expertise in the local market was invaluable. We truly appreciate her dedication, professionalism, and genuine care for her clients. We highly recommend her!

Sri H

Austin, 7 months ago

We had a fantastic experience working with our realtor, Julie. She was incredibly attentive to details throughout the process, ensuring nothing was overlooked. Her deep knowledge of the market helped us make informed decisions, and she was always available to answer our questions. Truly a great resource for anyone looking to buy or sell a home - highly recommended!

Soumya R

Austin, 8 months ago

Julie is a highly skilled real estate agent. Her expertise goes way beyond the "typical" and her creativity has no bounds. She's very in touch with the market and makes sound suggestions to give you the best chance of success. She works tirelessly around the clock and is strong at pivoting. I know Julie was working with other clients when she was also working with me but truly felt like I was her only one. She also has a strong network of professionals she can refer you to and is not afraid of sharing her experience or the experiences of others she knows. When you work with her you are truly getting the full package. 10 out of 5 star recommendation..

Miranda M

Austin, 3 year ago

Short-Term Rental Tax Strategies

The number one reason investors are interested in short-term rentals over long-term in the Austin market.

What Type of Property To Buy

Whether this is your first property or another addition to your portfolio, this type of property is tried and true performer.

Don't Know Where to Start?

Every investor has been there. Will this really work out or be too expensive or too much work? Let me help you understand where to begin.

Furnishing a Short-Term Rental?

Our guide to make you a Super Host in no time while taking out the guess-work.

READY TO Strategize?

Book a Free Strategy Call!

I am hear to sit down and talk goals for your first or to help you grow your portfolio

STILL NOT SURE?

Frequently Asked Questions

Is short-term rental investing still worth it in Austin?

Yes — but only if you buy the right property in the right area with a clear strategy. Austin still has strong demand driven by tech, events, healthcare, and universities, but regulations and neighborhood rules matter more than ever. The investors who succeed today are focused on data, zoning, and realistic revenue expectations — not speculation. That’s where experience and local knowledge make the biggest difference.

What types of properties work best as short-term rentals in Austin?

The best-performing STRs in Austin tend to be well-located single-family homes, duplexes, and small multifamily properties with flexible layouts. Proximity to downtown, major employers, hospitals, and entertainment areas is key. Properties that allow for strong guest experiences — outdoor space, parking, privacy — consistently outperform. Not every “nice house” works as an STR, which is why analysis matters.

Can I invest in a short-term rental in Austin if I live out of state?

Yes, many of my STR clients live outside of Texas. The key is having a local expert who understands Austin-specific regulations, neighborhood dynamics, and operational realities. I help out-of-state investors evaluate deals, coordinate inspections, and plan for furnishing and management. With the right systems, STR investing can be very hands-off.

How do Austin short-term rental regulations work?

Austin has specific rules around short-term rentals that vary by property type and location. Some areas allow STRs by right, while others have restrictions or caps. Zoning, permits, and neighborhood context all matter. I walk my clients through what is allowed, what is risky, and how to invest with eyes wide open — not assumptions.

What price range is best for short-term rental investing in Austin?

There isn’t one perfect number, but most successful STR investments in Austin fall between the mid-$500s and low-$900s, depending on location and strategy. Higher price points can still perform well when demand, layout, and nightly rates align. The goal isn’t the cheapest property — it’s the best return for the risk. I help investors evaluate that balance clearly.

How does bonus depreciation work with short-term rentals?

Short-term rentals often qualify for accelerated depreciation, which can significantly reduce taxable income when structured correctly. This may include bonus depreciation and cost segregation, depending on how the property is used. While I don’t provide tax advice, I help investors understand how STRs fit into a tax-efficient real estate strategy and coordinate with their CPA early in the process.

Do I need 20% down to buy a short-term rental?

Not always. Financing options vary based on whether the property is a second home, investment property, or primary residence. Some STR buyers use conventional loans, others use DSCR or portfolio loans. The right loan depends on your income, goals, and timeline. I help investors think through financing before making an offer.

What kind of returns should I realistically expect?

Returns vary based on location, property type, management style, and market conditions. I focus on conservative projections and downside scenarios rather than best-case numbers. A well-bought STR should aim to cash flow or at least break even while providing tax benefits and appreciation. Clear expectations upfront prevent disappointment later.

Is it better to buy a turnkey STR or renovate one?

Both approaches can work. Turnkey STRs offer speed and simplicity, while renovation projects can create value if done thoughtfully. The right choice depends on your experience level, timeline, and risk tolerance. I help investors evaluate both paths and avoid projects that look good on paper but fail in reality.

How do you analyze short-term rental deals?

I look at revenue potential, seasonality, operating costs, financing, regulations, and exit strategy. I don’t rely on a single number or platform. Instead, I focus on whether a deal still makes sense under conservative assumptions. The goal is clarity, not hype.

Do you help with furnishing and setup after closing?

Yes. For investors who want a turnkey experience, I have team members that will plan layout, furnishings, and design choices that support strong guest reviews and repeat bookings. Small details often make a big difference in STR performance. This is especially helpful for out-of-state buyers.

What’s the first step if I’m interested in short-term rental investing?

The first step is a strategy conversation. We’ll talk through your goals, budget, timeline, and risk tolerance before ever looking at properties. From there, we can decide if Austin — and STR investing — is the right fit for you. There’s no pressure, just clarity.

Opening hours

M: 9am - 9pm

T: 9am - 9pm

W: 9am - 9pm

T: 9am - 9pm

F: 9am - 9pm

Services

STR Advising

Property Operations and Optimizaiton

Buyer and Seller Representation

Agent Coaching

Important links

© 2026 Julie Hutchison Realtor - All Rights Reserved.